Air China, China Eastern Airlines, and China Southern Airlines, otherwise known as China’s Big 3, will focus on the domestic market this year even as localized Covid-19 lockdowns and restrictions challenge their operations.

The Chinese domestic market has taken a beating so far in 2022. January and February passenger numbers were up 12.5 percent year-over-year in January and February, CAAC data show. However, Covid outbreaks and a subsequent lockdown in Shanghai at the end of March that then spread to other cities in April likely curtailed that growth. And a new outbreak in Beijing may prompt a lockdown of that city as well.

Net losses totaled 9.9 billion yuan ($1.5 billion) at Air China, 8.3 billion yuan at China Eastern, and 4.5 billion yuan at China Southern in the first quarter. All three losses were wider than a year ago by as much as 4 billion yuan. Revenues decreased 11 percent year-over-year to 12.9 billion yuan at Air China, 5.5 percent to 12.7 billion yuan at China Eastern, and increased 1 percent to 21.5 billion yuan at China Southern.

“The short-term volatility of the epidemic will have a certain impact on service consumption and even domestic economy,” Shanghai-based China Eastern said in its 2021 annual report released April 28. The airline’s schedule has been hit hard by the lockdown in Shanghai, though it did not acknowledge the situation in its report. China Eastern forecasts a “slow recovery” in 2022.

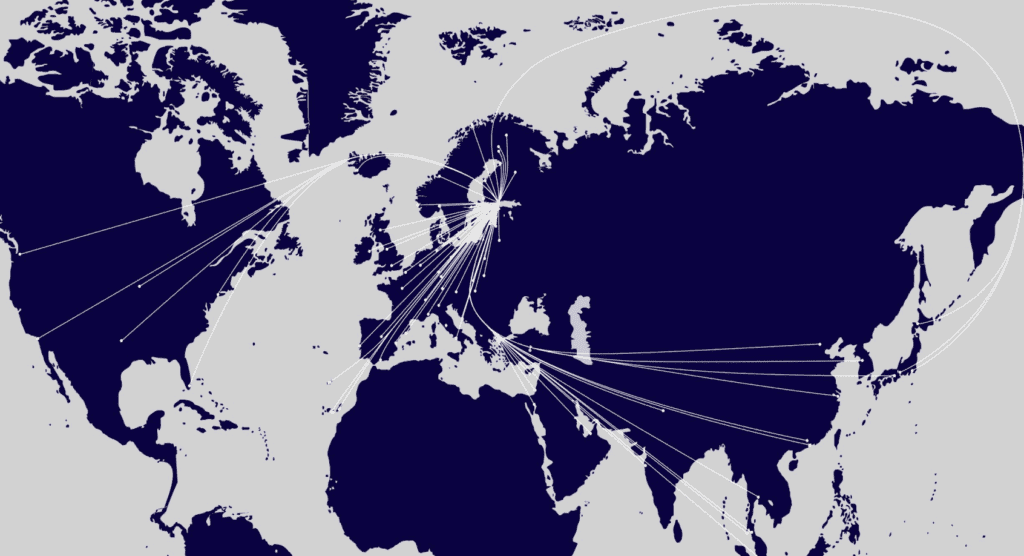

The emphasis of all three Chinese airlines in their newly released 2021 annual reports, which include multiple mentions China’s domestic economic initiatives that through 2025, is notable for its few references to international flying. Flights to foreign countries were one of the largest growth opportunities for Chinese airlines prior to the pandemic, but since the outbreak of Covid-19 two years ago, have become a minute part of their networks.

China Southern “will proactively participate in the construction of a strong country in the new era and support China’s civil aviation in building a strong country of civil aviation,” the Guangzhou-based airline said in its annual report released April 26.

“Civil aviation demand in China will continue to rise and market potential will remain immense,” Beijing-based Air China said in its annual report released April 26. The airline noted that slower domestic capacity growth in 2022 would “alleviate the short-term excess capacity pressure brought by transfer of some aircraft from the international market.” Air China did not comment on when it planned to resume much of its broad international route map.

The commentary from the three state-owned Chinese airlines meshes with government policy. The CAAC outlined in January a plan to focus on containing the Covid-19 virus and domestic growth through 2022, with most international air travel resuming from 2023.

“Chinese airlines’ managements generally are hopeful for activity pickup for upcoming holidays, including the 2022 Labor Day holidays and the summer travel season,” J.P. Morgan analyst Karen Li wrote on April 20. “With regards to cross-border travel, airlines’ managements see scope for tripling of weekly international flights around the year-end.”

In 2021, domestic passenger traffic recovered to 73 percent of 2019 levels at Air China; 75 percent at China Eastern; and 76 percent at China Southern. International traffic was another story: Air China was only back to 2 percent, China Eastern 2.4 percent, and China Southern 5 percent.

In addition to its outlook, China Southern outlined plans to resume flights with the 737 Max in 2022. The airline anticipates the arrival of 39 new Maxes, according to its annual report. Deliveries have been halted since 2019 when China grounded the aircraft following two fatal crashes in Ethiopia and Indonesia. The country is among the last to re-certify the Max since the U.S. became the first in November 2020. China Southern also plans to retire its last Airbus A380 this year.

Tatas to Consolidate Holdings With AirAsia India Deal

Air India, which was acquired by Tata Sons in January this year, wants to buy the AirAsia Group’s holdings in AirAsia India and bring the budget carrier fully into the Tata stable.

The pending deal would help Tata Sons consolidate its position over the Indian airline market. The group already owns four carriers out right: Air India, Air India Express, and Vistara, plus its majority stake in AirAsia India. Together, the four airlines have a nearly 25 percent share of Indian domestic capacity in April, according to Cirium schedules.

A reported planned merger of AirAsia India and Air India Express would heighten competition with market leader IndiGo, which had a 53 percent share of domestic capacity in April, Cirium shows.

Once the AirAsia India deal is done, Tata plans to consolidate all of its aviation entities in a single corporate complex in Gurugram, a corporate hub near India’s capital New Delhi. This would allow it to “optimise resources, increase team work and have higher synergies at work,” according to a memo sent to the airline management teams.

The Competition Commission of India disclosed Air India’s planned acquisition of AirAsia India during the week of April 25. The competition watchdog found that the deal would not change or adversely impact the competitive landscape in India.

Tata owns 83.7 percent of AirAsia India, and the Malaysia-based AirAsia Group the remaining 16.3 percent.

The budget airline deal follows Tata’s acquisition of Air India and its affiliates from the Indian government for $2.4 billion. The transaction covered full-service Air India, low-cost Air India Express, and ground handling services operator Air India Sats.

The Tatas wheeling and dealing comes as India preps for two new airlines: Akasa Air and a reboot of Jet Airways. Both are set to begin flights this year.

Training New Hires Is Southwest’s Staffing Bottleneck

Recent bookings have reversed Southwest Airlines’ formerly dim view of the return of business travel, with March corporate revenue exceeding March 2019. The Dallas-based airline is retooling its network away from some of the leisure-focused destinations it focused on during the depths of the pandemic to business markets as it prepares for road warriors to return.

Former CEO Gary Kelly, who stepped down earlier this year, famously said he thought about 20 percent of business travel will never return after the pandemic recedes, due to the changing nature of work and tools like videoconferencing. It still hasn’t returned in full, but it’s recovering faster than the airline expected. March corporate travel revenue was only 36 percent off the same month in 2019, compared with 70 percent below 2019 in January. Southwest is reducing the number of flights it operates to and within Hawaii and reallocating those resources to shorter-haul flights in business markets.

Crucially, Southwest is restoring frequencies between cities. Southwest’s pre-pandemic schedule depth allowed the airline to re-accommodate passengers in the event of a cancellation and boosted the airline’s reliability, critical to business passengers. Although schedule depth will not match 2019 levels until the latter part of this year, it has become Southwest’s focus. The airline said it needs about 125 aircraft to restore its schedule depth.

Southwest plans to take delivery of 114 aircraft this year and retire 28 Boeing 737-700s. In April, the carrier reached a deal with Boeing to convert 40 of its 737-7 orders to -8s for delivery this year, and moved one of its -7 orders to next year. Boeing still does not have a clear timeline for when the FAA will certify the -7. The airline also exercised options for 16 -8s for delivery this year and moved one -7 option to next year. As of last week, Southwest planned to take delivery of 81 737-8s and 21 -7s, plus options for another 12 aircraft, this year, Chief Financial Officer Tammy Romo said.

To fly these airplanes, of course, Southwest needs staff. This has been the biggest constraint on Southwest’s recovery, CEO Bob Jordan told analysts during the company’s first-quarter earnings call on April 28. The carrier had struggled to hire and train front-line employees when it resumed hiring in the autumn of last year. It has changed the way it hires by advertising jobs on social media, for example, and making “instant offers” at the conclusion of a successful candidate interview, President Michael Van de Ven said. The airline plans to hire 10,000 people this year, and 8,000 per year for at least the next two years.

And although Southwest has had success in attracting talent, it struggles with training all these new employees, Jordan said. The carrier needs to hire 1,200 pilots this year, to replace the 640 who retired during the pandemic, but it doesn’t have enough flight instructors to train the new hires quickly enough. Southwest needs to hire about 35 flight instructors to train its pilots this year and, in order to grow beyond that, needs to hire as many as 60. “Every airline is looking for flight instructors now,” Jordan said.

Across all workgroups, new employees are going through the training pipeline and are learning their jobs, a process that takes time. Van de Ven estimated it takes between six months and a year for a new airport-based employee to become proficient at his or her job. Although Southwest has hired thousands of people, they are not performing at their peak productivity yet. As a result, Southwest is keeping its capacity about 7 percent lower than in 2019 in the second quarter.

Southwest is being cautious this year despite surging demand. Last summer, when demand began to spike, the airline didn’t have the staff on hand to operate its planned schedule or to recover from delays caused by bad weather. This summer, Jordan said it learned its lesson and is keeping a careful watch on matching capacity with its ability to execute, and not just with demand.

The carrier forecast a profit in the first quarter but reported a net loss of $278 million, thanks to the spread of the Omicron variant. Revenues in the first quarter were $4.7 billion, down 9 percent from 2019. But the surge in demand in March, along with forward bookings for the summer and beyond, give the carrier confidence in the rest of the year.

Southwest expects to be profitable again from the second quarter and for the full year. Southwest is rare among U.S. airlines in hedging its fuel costs. The carrier is reaping the benefits now, when jet fuel prices are among the highest they have been in 10 years. The airline’s hedge portfolio will give it a $1 billion benefit this year and protects it from the volatility in oil prices caused by the Ukraine war. “Our fuel hedge is providing excellent protection against rising energy prices and significantly offsets the market price increase in jet fuel in first quarter 2022,” Romo said.

JetBlue Finds New Revenues Amid Staffing Issues

JetBlue Airways had few things to celebrate during its first-quarter results call. Executives were put to task about the airline’s April operational meltdown and the added costs it expects this summer to avoid further snafus.

The New York-based carrier cancelled roughly 10 percent of its schedule during the first three weeks of April, or equivalent to roughly 2,250 flights based on Cirium schedule data. The situation has made JetBlue a pariah among its U.S. peers in forecasting a second-quarter loss while the rest of the industry appears poised to return to the black.

But there was a bright spot for the airline: revenue momentum is building and ancillaries — fees for things like an extra legroom seat to priority boarding — jumped in the first quarter. JetBlue President Joanna Geraghty said on April 26 that ancillary revenues increased 70 percent during the March quarter compared to 2019. This increase in ancillary revenues, which JetBlue does not break out from other passenger revenues, and the higher airfares airlines are commanding mean total revenues are on track to jump as much as 20 percent in the second quarter before a four point hit from the April issues.

“We are set to generate our best quarterly revenue results in the second quarter and are positioned to accelerate this momentum through the summer,” Geraghty said. JetBlue forecasts an 11-16 percent increase in revenues compared to 2019 in the June quarter.

Revenue tailwinds for JetBlue include its new Northeast Alliance with American Airlines, and expanded loyalty tiers. In addition, it saw lucrative corporate travel recover to 75 percent of 2019 levels in March.

The added income from ancillaries and other measures are welcome as JetBlue faces a large run up in costs. Unit costs excluding fuel — a measure of how much it costs the airline to carry a passenger one mile — jumped 13.9 percent year-over-three-years in the first quarter, and is forecast to rise 10-15 percent for all of 2022. Healthy unit costs excluding fuel growth is seen as equal to or less than the rate of national economic growth.

Much of those added costs come from the situation JetBlue executives were answering for: Operations.

JetBlue has drastically pulled back its growth outlook for 2022 in an effort to stabilize its operations. The airline plans to fly only as much as 5 percent more capacity this year than in 2019; an up to 10 point downward revision from January. And in the second quarter, JetBlue plans capacity that is flat to up 3 percent year-over-three-years.

The cuts, as Geraghty put it, take into account: “elevated pilot attrition, pilot training delays stemming from disruptions to planned training schedules due to Omicron, business partner staffing shortages and [air traffic control] staffing shortages.”

But the pilot situation is worse for JetBlue than many other U.S. carriers. The airline is now planning for elevated pilot attrition rates for the first four years that crew members fly for JetBlue, said Geraghty. In other words: It has become something of a farm team for the Big 3 — American, Delta Air Lines, and United Airlines — rather than being a long-term career for aviators.

“JetBlue historically, it’s a destination carrier for airline professionals historically. And yet now, it does seem like maybe for some, it’s a stepping stone,” Deutsche Bank analyst Michael Linenberg said on the call.

Geraghty and other executives pushed back on the characterization of JetBlue as a “stepping stone” for jobs at other airlines — a role typically reserved for regional carriers, like Cape Air or Mesa Airlines. However, she acknowledged that JetBlue is now including elevated attrition rates in its long-term staffing and capacity plans. Some pilots, for example, want to fly widebody jets and leave JetBlue for jobs where they can fly those types, she added.

“The access to pilots really becomes the governing factor for growth in the industry over the next few years,” JetBlue CEO Robin Hayes said.

Raymond James analyst Savanthi Syth estimates that U.S. airlines will hire roughly 13,000 new pilots annually this year and in 2023. However, the current training and certification process only produces roughly 5,000 to 7,000 new pilots per year.

JetBlue executives said that, despite the pilot situation, its capacity cuts and other readiness efforts will translate to operational reliability for travelers this summer.

JetBlue reported a net loss of $255 million in the first quarter. Revenues decrease 7.3 percent compared to 2019 to $1.7 billion on a 17 percent increase in expenses to $2.1 billion. Unit costs excluding fuel increase 13.9 percent compared to 2019. Passenger traffic was down 14 percent on 0.3 percent less capacity.

Hayes declined to comment on JetBlue’s pending bid to acquire Spirit Airlines. He deflected questions on a decision timeline to the Florida-based discounter, which has said is considering JetBlue’s offer over one from Frontier Airlines.

Looking forward, the combination of extra April expenses and slower capacity growth means JetBlue forecasts a second quarter loss despite record revenues. Unit costs excluding fuel are forecast to rise 15-17 percent compared to 2019.

“I think 2023 will be the first year we’re actually comping against the year before as opposed to 2019,” said Hayes in a sign that JetBlue has written off 2022 as another so-called recovery year.

Air Canada Targets 2023 or 2024 for Recovery

Air Canada expects traffic and revenues to start matching 2019 levels by the first or second quarter of next year, with the full recovery now forecast for 2024, a sharp contrast from its peers in the U.S., which are increasingly bullish about the second half of this year.

Canada’s emergence from the pandemic has been slower than in the U.S., Air Canada Chief Commercial Officer Lucie Guillemette told investors on the company’s first-quarter 2022 earnings call on April 26. In particular, the return of what she termed “Corporate Canada” has lagged the resumption of business travel in the U.S. Air Canada’s large corporate accounts still are on the sidelines of the travel recovery, she said. By the second half of this year, Air Canada estimates business traffic in North America as a whole will be 20-30 percent off 2019. Now, systemwide, business travel is half of what it was in 2019.

But within business travel, there are bright spots, Guillemette noted. Small- and medium-sized businesses have been traveling more than their larger corporate counterparts, but these passengers tend to fly economy, in smaller groups, than corporate clients. “Our exposure is manageable given the size of our premium cabins,” she said. Transborder traffic with the U.S. — a key business market for Air Canada — is rising and is forecast to be 90 percent of 2019 levels this summer.

Business travelers may not be sitting in the front of the aircraft, but leisure travelers are. Air Canada’s premium cabins performed better during the depths of the pandemic than economy cabins, and this trend shows no sign of abating. And the premium economy cabin has performed the best of all fare classes across Air Canada’s network, Guillemette said. She did not, however, break out revenue figures for premium economy.

Air Canada expects summer capacity still to be down from 2019. The carrier is planning to operate 20 percent less capacity than it did three years ago systemwide. This, however, is 414 percent more than the carrier flew in the second quarter of last year, when Canadian travel restrictions were among the most stringent in the world. Although North America and transatlantic demand is expected to be strong, the carrier is planning for demand on its Asia network to be depressed through next year. Air Canada is focusing on its strengths for the balance of this year: Transborder and sixth-freedom connections from the U.S. to Europe, Guillemette said.

Another difference between Air Canada and its U.S. peers is that the airline is not suffering from a pilot shortage. Air Canada kept all its pilots on the payroll and current during the pandemic, so it does not foresee any difficulties operating its planned summer schedule. It has seen some shortages of ramp employees, but the carrier said it has the staff it needs for the summer.

Fuel prices could be an issue as the carrier plans to ramp up capacity for the summer. Prices for jet fuel are the most volatile they have been since the 2008 financial crisis, Chief Financial Officer Amos Kazzaz said. The crack spread — the difference between the price of crude oil and distillates, like jet fuel — are higher than they have been in memory. “You can’t hedge crack spreads,” he said. Air Canada, like its peers in the U.S., believes it can pass on the additional fuel costs to passengers. The carrier is tankering in fuel from central Canada to Ontario and on flights to the East Coast of the U.S. and the Caribbean to avoid higher jet fuel prices in those regions.

Air Canada is betting fleet renewal can help alleviate fuel costs. The carrier took delivery of three Boeing 737-8s in the quarter, bringing its total for the type to 34, and expects to take delivery of six more this year. The carrier also took delivery of one Airbus A220 in the quarter and now has 28 of the type in its fleet. It will take delivery of six more A220s this year.

Air Canada also took delivery of two Boeing 767Fs in the quarter, and they are expected to help fund the carrier’s cargo network expansion into Europe and Atlantic Canada. Cargo has been a bright spot during the pandemic, especially on routes to Asia; however, near-term Asian cargo traffic could take a hit with quarantines in effect in Shanghai and potentially in Beijing, Kazzaz said. But with passenger demand returning, Air Canada is re-converting six Boeing 777-300s and three Airbus A330 preighters back to passenger configurations.

Air Canada reported first-quarter operating revenues of C$3.1 billion ($2.4 billion), or more than 300 percent higher than last year. But it continued to lose money, reporting a pre-tax loss of C$814 million, down sharply from the C$1.4 billion pre-tax loss it reported last year. CASM is expected to remain 13-15 percent higher than in 2019 for the rest of the year, due in part to higher fuel prices, rising labor costs as the carrier recalls employees, and the costs associated with adding new aircraft to its fleet.

Avianca in Deal for Viva Air

Avianca embraced a low-cost model as part of its U.S. Chapter 11 bankruptcy reorganization, and now has plans to acquire budget competitor Viva Air.

Financial terms of the deal that was announced on April 29 were not released, but Viva Air, which has operations in Colombia and Peru, would become part of the newly reconstituted Avianca Group. The two airlines will continue to operate separately under their own brands, at least for the time being. Combining fully would require regulatory approvals in both Colombia and Peru. In addition, Viva founding partner and Executive Chairman Declan Ryan would join the Avianca board.

“This new and robust group of airlines will benefit customers by using a more efficient cost structure to offer lower fares, a route network that delivers direct connections between destinations, a strong loyalty program,” said Roberto Kriete, Avianca’s main shareholder and board chairman, in a statement.

While Avianca’s acquisition of Viva comes as something of a surprise, the fact that it is participating in consolidation of the Latin American aviation market does not. “Do we believe in consolidation as a good thing for the industry across the region? We do,” Avianca CEO Adrian Neuhauser told Airline Weekly in October.

At the time, there was chatter about a possible combination between Avianca and Chile’s Sky Airline. That deal, which was pushed by two of Avianca’s creditors, Caoba Capital and Elliot Investment Management, has not come to fruition.

A merger of Avianca and Viva makes some sense. The former emerged from Chapter 11 having slashed expenses and with a business plan that called for denser seating on its aircraft and more point-to-point routes bypassing its Bogotá hub and increasing the utilization of its fleet — all of which are hallmarks of discounters like Viva. Avianca even began adding flights that competed with Viva at the latter’s new Medellin hub.

Avianca and Viva together would have a 67 percent share of domestic Colombian capacity in April, according to Cirium schedules. Their next largest competitor, Latam Airlines Group, has a 26 percent share. Avianca closed its Peruvian subsidiary in 2020 thus Viva would be a return of sorts for the airline to the market that is among the fastest growing in South America.

Separately, Avianca officially delisted from the New York Stock Exchange on April 27 after trading was suspended in December. The reorganized airline is expected to go public again, however, it has not said where it will list.

Gol Eyes U.S. Expansion

Gol is feeling the benefit of its expanded strategic alliance with American just weeks after the pact was finalized.

Paulo Kakinoff, CEO of Gol, said on April 28 that the partnership with American is already two times larger than the Brazilian carrier’s former tie-up with Delta, which ended in March 2020. That is significant given that, while American and Gol unveiled plans for a codeshare in early 2020, the alliance only began to take off once restrictions on international travel between Brazil and the U.S. eased last year. The airlines unveiled a strategic partnership in September that was finalized when American closed a $200 million investment in Gol on April 13.

But things are not stopping there. Gol is considering more flights to Miami, a large American hub, from Brazil with its rapidly growing fleet of Boeing 737 Maxes. The planning, which executives did not provide any specifics on, comes as Gol prepares to relaunch U.S. flights in May: Orlando resumes on May 13, and Miami on May 17, according to Cirium schedules. Both Florida cities will be served nonstop from Brasilia after a two-year hiatus.

“There is a significant narrowbody operation that we can develop in partnership with American out of Miami, if American focuses [its] widebodies on the longer distances,” Gol Chief Financial Officer Richard Lark said during Gol’s first-quarter earnings call on April 28.

American serves only Rio de Janeiro Galeão and São Paulo Guarulhos from Miami, Cirium shows. It ended service to Brasilia in 2020, and Manaus in 2021.

In addition to reconnecting Brasilia to American’s Miami hub, Gol’s 737-8s could also fly the Miami-Manaus route. Other possible markets mentioned by Wall Street analysts include Belem, Recife, and Salvador. American connected Miami to Recife and Salvador until 2016, according to Cirium.

“We are taking careful notes,” Kakinoff said in response to the analyst suggestions. He added that more U.S. routes were coming but noted that there are no immediate plans to seek antitrust immunity with American, which would allow the two airlines to coordinate on flights between Brazil and the U.S.

Gol’s new air freight agreement with Mercado Livre, an e-commerce and online auction company, is set to take off in the second half. The airline anticipates 100 million reais ($19.9 million) in incremental revenue from the pact that covers six Boeing 737-800 freighters this year. The financial benefit is expected to ramp to 1 billion reais within five years.

Aside from its commercial deals, the first quarter — historically the strongest in Brazil — was good for Gol. The airline posted a 2.6 billion reais net profit in the period, which was a reverse from a loss in the fourth quarter but not its first pandemic profit after a 658 million reais profit in the second quarter of 2021. Revenues increased 105 percent year-over-year to 3.2 billion reais, and were up less than 1 percent compared to 2019. And on the financial metrics important to airlines: Passenger unit revenues jumped 28 percent year-over-three-years on a 6 percent increase in unit costs excluding fuel.

Gol’s results benefitted from a 60 percent jump in bookings in March compared to prior months, Kakinoff said. This include a dramatic rebound in corporate travel.

And in terms of fuel, Lark said Gol has been able to fully recapture the increase in prices through higher fares and yield management. The airline saw its average fuel price rise just 7 percent in the first quarter from the one prior, which benefitted from changes in the value of the reais versus the U.S. dollar.

The airline’s outlook for 2022 is unchanged from the guidance it provided in March. Gol forecasts a 10 percent earnings before interest and taxes (EBIT) margin, and plans to have 130-140 aircraft in its fleet by year-end.

Finnair Retools For Lengthy Russian Airspace Closure

Few European airlines bear the weight of sanctions on Russia and the closure of the country’s airspace more than Finnair. In the early days of the war in Ukraine, the carrier was forced to suspend its flights to North Asia while it found viable routings around Russia, and even now, must fly up to 40 percent longer to Seoul, Shanghai, and Tokyo, once mainstays of its international network.

“Nobody really knows how long Russian airspace will remain closed,” Finnair CEO Topi Manner said during the airline’s first-quarter results call on April 27. “What is clear is, first, a peace in Ukraine would be needed and then, after that, the political discussion of the willingness to lift at least some of the sanctions would start.”

Manner does not expect Western countries to move quickly to lift sanctions, imposed shortly after Russia invaded Ukraine on February 24. Nor does he expect Russia to ease its overflight bans. And that means changes big and small are afoot for Finnair, which prior to the pandemic did good business connecting Europe and North Asia via its Helsinki hub. The airline has already pivoted its long-haul network towards more South Asia and U.S. flying but also has turned to wet-leasing and selling aircraft to reflect its lower-than-planned flying levels. It also plans to shave another €60 million ($63 million) in annual savings from its business.

Finnair will operate 73 percent more capacity to North America in the September quarter than it did in 2019, according to Cirium schedules. And to South and Southeast Asia, it will operate 2 percent more capacity. This growth is driven by the network additions of Dallas-Fort Worth in March, Seattle in June, and Mumbai in August, as well as the nearly doubling of Delhi flights this summer.

“When you fly from India to the U.S. and vice versa, it makes sense to fly through the Helsinki hub. We have a competitive offering,” said Manner. The uptick in transfer passengers between the two regions is supporting the additional transatlantic capacity, he added.

But the map changes are not enough to offset the flying Finnair has suspended to Asia, some of which is due to the Russian airspace closure but much the result of continued Covid-19 border restrictions, particularly in China. Overall Asia capacity will be down 65 percent in the third quarter, which includes the suspensions of 10 cities ranging from Beijing to Fukuoka and Xi’an, Cirium shows.

Finnair plans to fly roughly 70 percent of its 2019 system capacity this summer, Manner said. That number rises to roughly 80 percent when including the aircraft wet-lease deals it has with British Airways and Lufthansa.

The wet-leases allow Finnair to put its otherwise idled aircraft — and staff — to work. BA will take four Airbus A321s, and Lufthansa three Airbus A350s, Manner said. These contracts allow Finnair to avoid involuntary staff furloughs for the summer season, he added.

But long-term Finnair recognizes that it must shrink. The airline has already sold four A321s and reduced its total fleet count to 80 aircraft, including 24 operated by affiliate Nordic Regional Airlines, Manner said. It is evaluating additional sale opportunities and looking for more wet-lease work particularly in the slower winter months. Manner did not say what number of aircraft Finnair targeted in an operating environment where Russian airspace remains closed indefinitely.

Finnair’s shifting business strategy is in contrast to what is otherwise a buoyant market. Bookings in Europe and to South Asia and the U.S. are “close to” pre-pandemic levels, and demand for the airline’s products, including its new premium economy cabin, is robust, said Manner. As such, Finnair expects to narrow its operating loss to roughly €65 million in the June quarter from €165 million in the March quarter. The airline maintains its expectation of a passenger traffic recovery in 2023.

Another bright spot for Finnair is cargo. Freight revenues were up 155 percent compared to 2019 to €121 million in the March quarter. But cargo yields between Europe and both Japan and South Korea increased as much as 165 percent from February to March after the Ukraine war began, said Manner. These high yields are helping support the airline’s continued flights to Seoul, Shanghai, and Tokyo. Systemwide cargo yields were up 150 percent year-over-three-years in March.

“Our operating environment is stabilizing … and we’re breaking the pattern of only commenting the next quarter as we have during the pandemic,” said Manner.

Despite the stabilizing environment, Finnair does plan to begin drawing down a €400 million capital loan from the state of Finland during the second quarter, said Manner. Draws will be used to bolster the airline’s balance sheet as its equity ratio is expected to fall below pre-defined limits.

Finnair reported a pre-tax loss of €212 million in the first quarter. Revenues of €400 million were up 252 percent year-over-year, but down 41 percent compared to 2019. Passenger traffic was down 61 percent year-over-three-years on a 35 percent decrease in capacity.

Hawaiian’s Recovery Depends on Japan’s Reopening

It’s all about Japan. That’s what analysts grilled Hawaiian Airlines executives about during the company’s first-quarter earnings call on April 26. And executives expressed their frustration with the country’s ongoing Covid travel restrictions.

Before the pandemic, Japan routes comprised 70 of Hawaiian’s international revenue. Its international network revenue now is about 25 percent of what it was in 2019. Even though Australia and South Korea have opened up, Hawaiian’s network can’t be what it was until Japan reopens. The weakness of Japan traffic will result in Hawaiian’s systemwide capacity to be down between 11.5-14.5 percen tin the second quarter.

The country has dropped its most stringent quarantines, but it is capping arrivals at about 10,000 per day spread across international airlines in order to allow arrival testing of each passenger, Hawaiian CEO Peter Ingram said. Before the pandemic, roughly 150,000 passengers per day flew to Japan from abroad, he added.

But Japan is showing no signs of relaxing the testing requirement or arrival caps any time soon, Ingram said. The country did relax some rules before the Summer Olympics last year, but it halted its reopening due to the Delta and Omicron variants. The restrictions that remain are politically popular, so it is unlikely they will be lifted before elections in July, Ingram said.

But when it does reopen, Ingram believes Japanese tourists will flock back to Hawaii. The snap back won’t be immediate, and he didn’t predict when it would start to occur, but he estimated it would happen within several months after the remaining restrictions are eased. “We’re looking forward to having Japan join the part in a meaningful way.”

Traffic to Australia and South Korea soared after those countries began to lift restrictions. Bookings for summer travel are strong enough for Hawaiian to add frequencies to Seoul, now up to five times per week. Load factors, now in the 30 percent range, are forecast to rise to the mid-70 percent range in June.

Domestic routes to the U.S. mainland are another story altogether. In the second quarter, Hawaiian expects to operate 117 percent of its pre-pandemic mainland capacity, with load factors forecast above 90 percent. Rising inflation, and the resulting rise in fares and hotel room rates, have not dented demand for Hawaiian vacations, Ingram said. In fact, premium demand is stronger now than it was in 2019, with unit revenues from the front of the aircraft 8 percent higher than before the pandemic.

Interisland traffic is starting to come back and is now 80 percent of 2019 levels. Ingram believes interisland will be smaller after the pandemic than it was in 2019, as demand has not returned and may not be restored to pre-pandemic levels. Hawaiian still is committed to the Boeing 717 for interisland flights and expects to operate the fleet until the middle of this decade. The carrier is considering replacements, although management did not elaborate on the aircraft type under consideration.

The carrier’s CASM excluding fuel will be 16.5-19.5 percent higher than it was in the second quarter of 2019, driven by increased training costs, and new labor contracts. Fuel costs rose 12 percent in the quarter, to $2.83 per gallon. In the second quarter, Hawaiian expects fuel costs to rise to $3.59 per gallon. Hawaiian was largely immune to the turmoil recently affecting New York Harbor jet fuel, as it sources most of fuel at Singapore jet fuel prices.

The year is heading up, but the quarter still was loss-making for Hawaiian. The carrier reported revenues of $477 million, up 162 percent from last year, but 33 percent below the second quarter of 2019. This resulted in an operating loss of $148 million. The carrier did not offer guidance for the rest of the year.

In Other News

- The SkyTeam alliance has temporarily suspended Aeroflot, the group said in a short statement last week. The alliance added that it is working to “limit the impact for customers and will inform those affected by any changes to SkyTeam benefits and services.” Among SkyTeam members, Delta suspended its codeshare agreement with Aeroflot shortly after Russia invaded Ukraine on February 24.