Qatar Airways Poised to Expand Post-Pandemic Routes Through New Partnerships

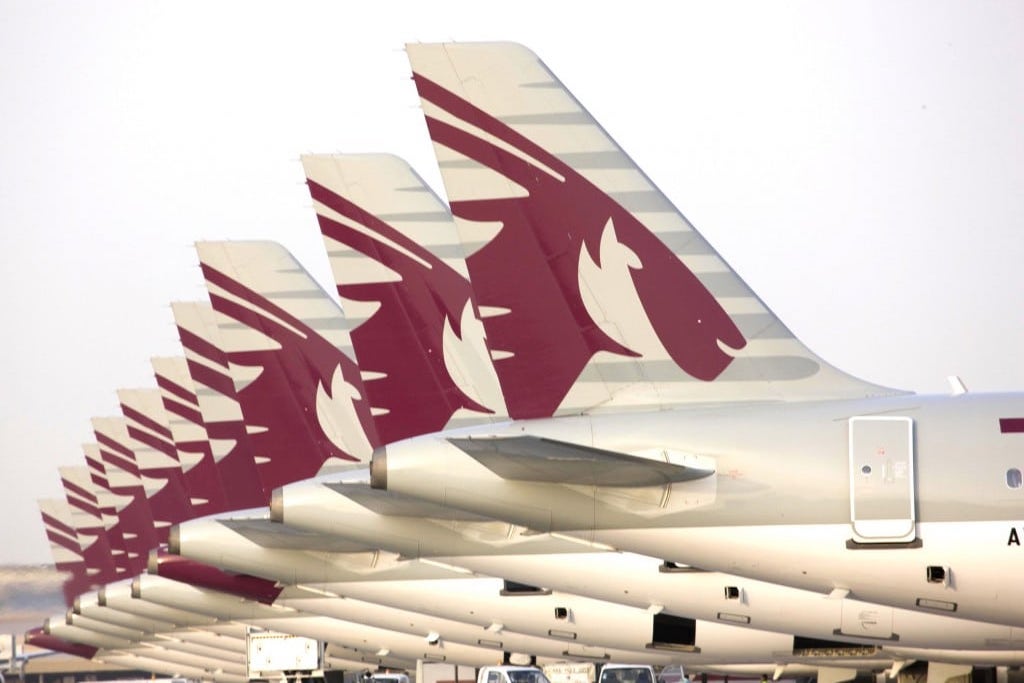

Photo Credit: Qatar Airways

As Qatar Airways begins to climb out of the worst of the pandemic, the Doha-based airline is even more convinced of the value of its partnerships and alliances, particularly with airlines in areas of the world that are further along in their post-pandemic recovery.

Qatar Airways is a member of the Oneworld alliance, a stark contrast from its immediate competitors United Arab Emirates-based Etihad Airways and Emirates Airline, which are unaligned and have fewer partnerships with other carriers. But like those airlines, Qatar is based in a geographically small country with no domestic market to speak of. Airlines that have seen demand return are those that serve large domestic markets, as in the U.S., China, Russia, and Brazil, or the single market of the European Union. Partnerships and the Oneworld alliance have given Qatar better access to markets that have recovered the most.

"There is a lot of value of us in Oneworld, for customers and for the airline," Mark Drusch, Qatar Airways senior vice president of revenue management, alliances, and strategy, told Airline Weekly. "We are big believers in the alliance."

The carrier recently announced deeper relationships with JetBlue, American, and Alaska in the U.S. With the U.S. market rebounding more quickly than those in Asia and other parts of Qatar's network, the carrier is increasing frequencies to its partners' hubs. Qatar has restored service to 12 U.S. destinations and has either raised frequencies or upgauged at American's hubs in Los Angeles, Chicago, Dallas/Fort Worth, Miami, and Philadelphia; JetBlue's hubs in New York and Boston; and Alaska's hubs in Seattle and San Francisco. In addition to these, Qatar operates to Washington, D.C., Houston, and Atlanta.

Drusch singled out the growth of the Alaska partnership, which was announced in December. By January, average daily sales were about 300 passengers per day but have quadrupled since then, he said. Alaska Vice President for Network and Alliances Brett Catlin said about 100 passengers per day connect across both networks. "When you put the two systems together, particularly with the customer base Alaska has, it creates traffic you can't imagine," Drusch said, pointing to such diverse itineraries as Khartoum-Phoenix and Fairbanks-Perth.

Similarly, the American partnership has revealed strong demand from American's system to the Middle East, the Levant, Subsaharan Africa, and South Asia. "We provide one-stop connections that no other partnership can deliver," Drusch said.

Across Qatar's system, markets that were previously strong have struggled with pandemic restrictions or new outbreaks of the disease. Australia, Southeast and North Asia remain depressed, due to travel restrictions. Nepal, Bangladesh, and Pakistan also are struggling to contain Covid-19, Drusch said.

"Exotic leisure destinations," like the Seychelles, Maldives, and Tanzania have been resilient. Demand is picking up to those destinations, as consumers spend money saved during the worst of the pandemic and plan postponed trips. "People have a lot of money, and they haven't traveled in 12-18 months," Drusch said. Demand across Africa has been relatively strong as well, he said.

The booking curve remains short, although it is lengthening from the worst days of the pandemic. Still, Qatar is seeing bookings average about four to six weeks before travel, a relatively short amount of time for a longhaul airline, Drusch said.

Cargo has been a lifeline for Qatar through the pandemic and will remain at the fore of the airline's planning even as the world returns to normal. Although always important — particularly during the years when Qatar's neighbors blockaded the country — it was a secondary concern. Cargo planners always had to "fight for aircraft," but now "they have a seat at the table," Drusch said.